Opportunity Zones and Farmland Investments

Published on Jul 21, 2022 by Peoples Company

By Heather Welch Puri | Director of Strategy & Finance, Capital Markets

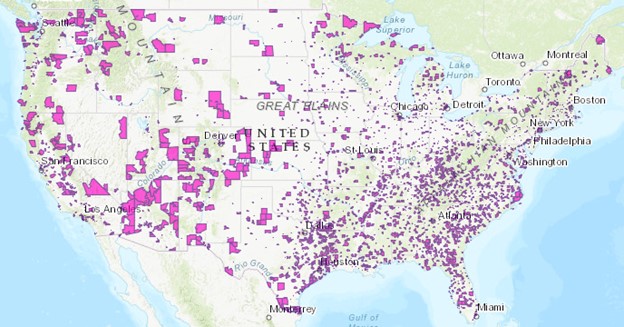

The 2017 Tax Cuts and Jobs Act created a new opportunity for individuals to receive special tax incentives by investing in Opportunity Zones through Qualified Opportunity Funds. The federal government created this program to encourage investment, development, and job creation in economically distressed communities. There are currently over 8,700 Qualified Opportunity Zones in the United States, “many of which have experienced a lack of investment for decades.”(1) Rural areas make up approximately 23% of these Qualified Opportunity Zones.(2)

Source: U.S. Department of Housing and Urban Development

Qualified Opportunity Zone investments present an attractive option for investors seeking to defer capital gains. Potential benefits to individuals investing in Opportunity Zones through a Qualified Opportunity Fund (QOF) include the following: (3,4,5)

- Temporary deferral of taxes on previously earned capital gains. Investors who have recently completed a sale or exchange of real property can reinvest their realized capital gains into QOFs up to 180 days after closing. Taxes on those gains can be deferred until the end of 2026.

- Basis step-up of previously earned capital gains invested. Taxable capital gains are reduced by 10% or 15% if the QOF is held for five or seven years, respectively.

- Permanent exclusion of taxable income on new gains. Capital gains from the QOF are tax-free if the QOF is held for at least 10 years.

Although the basis step-up portion of the Qualified Opportunity Zone program expired at the end of 2021, QOZ investments can still be very beneficial to investors. “The larger benefits of tax deferral and the potential for a tax-free exit far outweigh the step-up in basis.” The option to defer taxes, and potentially eliminate taxable profits entirely, is particularly important “in light of an uncertain market with inflationary conditions and recent taxation proposals that would significantly boost the rate at which capital gains are taxed.” In addition, a bipartisan bill introduced in April 2022 could allow for an extension of the tax incentives, as the effective date for investors to realize a 10% step-up in basis would be extended to December 31, 2028.(4)

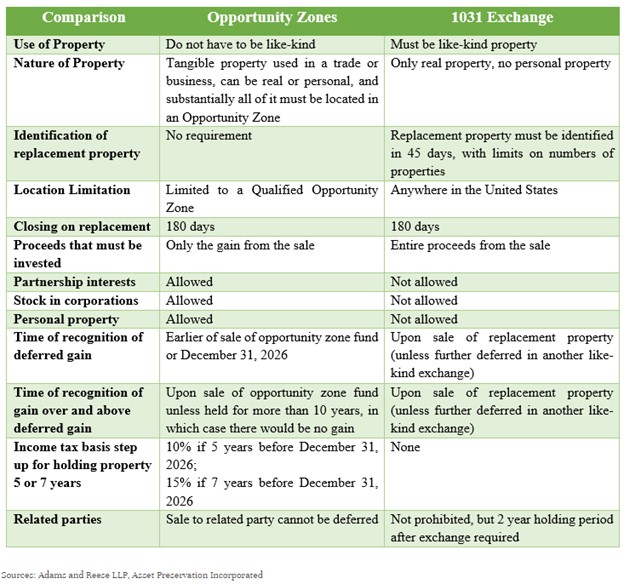

Qualified Opportunity Zones vs. 1031 Exchanges

Although Qualified Opportunity Zones and 1031 Exchanges both provide tax advantages to investors, there are significant differences between them. Investors should consider factors such as liquidity needs and long-term investment objectives when considering these two options for deferring capital gains.(6)

Farmland Opportunity Zones

Farmland is known to provide several key benefits to investors, including valuable portfolio diversification, low volatility of returns, an effective hedge against inflation, and innumerable social and economic benefits. Further, farmland has historically outperformed the S&P 500 and other asset classes by a multiple of 2 times or more. When coupled with Qualified Opportunity Zone’s tax incentives, farmland can be a very compelling asset class for investors.

The Promised Land Opportunity Zone Fund estimates that there is roughly $300 billion worth of Opportunity Zone farmland in the U.S., providing a large addressable market for investors. While there is a “substantial improvement requirement” on all Opportunity Zone properties, substantial improvement applies to any structure on the land. With respect to farmland, improvements can include minor modifications, such as building grain bins, all the way to larger capital projects, such as land leveling or installing irrigation equipment. Importantly, development of permanent crops (trees with fruit or nuts) count toward the substantial improvement provision as well.(7)

Farmland Investment Opportunities

Investing in Qualified Opportunity Funds can be very compelling to investors seeking to defer capital gains. As many Qualified Opportunity Zones are located in rural areas, QOZs are especially attractive when considering long term investments in the relatively low risk farmland asset class.

PC Capital Market’s asset management platform leverages Peoples Company’s national network of brokers, appraisers, and land managers. The brokerage network supports a robust pipeline of acquisition opportunities, including those located in Opportunity Zones. The appraisal network provides unique market intelligence across asset types, production systems, and regions. The land manager network delivers connections by region and crop to support conventional row crop and permanent crop production and crop marketing. Coupled with Peoples Company’s market-leading farmland transaction services, PC Capital Markets has the local knowledge and national scale infrastructure to connect interested capital with the right farmland assets. To discuss farmland acquisitions and capital deployment with the PC Capital Market’s team, email us at CapitalMarkets@PeoplesCompany.com

(1) U.S. Department of Housing and Urban Development, Opportunity Zones.

(2) Kiplinger, Real Estate Investing. “Qualified Opportunity Zones vs. 1031 Exchanges,” June 4, 2022.

(3) Tax Policy Center, Urban Institute & Brookings Institution, Tax Policy Center. “What are Opportunity Zones and How do They Work.”

(4) TheStreet, Retirement Daily. “Investing in Qualified Opportunity Zones,” D. Reynolds, June 2, 2022.

(5) MYRA Inc. “Tax Benefits of Investing in Opportunity Zones.”

(6) Harvest Returns. “Opportunity Zone Investments: What Farmers & Investors Need to Know,” October 29, 2018.

(7) OpportunityDb, “Farmland Opportunity Zone Investing, With Paul Pittman & John Heneghan,” December 8, 2021.