Why to Consider Property Taxes When Making Farmland Investment Decisions

Published on May 26, 2021 by Peoples Company

By Hunter Norland | Acquisitions Manager, Land Investment

“There are only two things certain in life: death and taxes.” This famous quote credited to Daniel Defoe, Benjamin Franklin, or Mark Twain (depending on the source) implies that taxes must be considered in decisions as they are irrefutable. Specifically, the reality of property taxes needs to be understood and accounted for when making farmland investment decisions.

What are Property Taxes?

Property taxes are an ad valorem tax meaning the amount is calculated as a proportion of an estimated value. The tax is assessed and levied by a governing authority of a jurisdiction where the property is located. Every county in each state has its own Assessor or Director of Equalization that decides or “assesses” the value of all property located in their jurisdiction including ag land real estate, commercial properties, buildings, permanent improvements, and residential dwellings. Typically, a mill levy is calculated and multiplied by the assessed value of the owner’s property at that point in time. The mill levy, assessment ratio, or rate of tax is calculated as a percentage of the assessed value and expressed as dollars of tax per hundred dollars of assessed value or per thousand dollars of assessed value depending on the jurisdiction of the property.

What is the Purpose of Property Taxes?

The proceeds from property taxes represent one of the principal sources of income for local governments in the United States. The amount taxed on an annual basis is adjusted depending on a municipalities’ fiscal need as well as current inflation rates. The proceeds from property taxes are used to support local school districts, public safety providers including police officers, firefighters, and other emergency response workers, and maintaining public use areas such as streets and roadways. Property taxes should be viewed as a necessary evil given the aforementioned items. Communities would lack infrastructure, education, and basic safety without property owners contributing to these services.

Property Tax Exemptions and Appeals

If qualification standards are met, there are a few exemptions available to lower property taxes. Exemptions include Homestead Credit, Military Exemption, Disabled Veteran’s Homestead Tax Credit, and Credit for Senior and Disabled Citizens. In addition, numerous exemptions exist for conservation easements and improving wildlife habitat including wetlands, native prairies, and forest reserves. Programs and incentives are also available to promote renewable energy and prevent urban sprawl.

Property owners can appeal the amount owed for property taxes if there is a dispute or disagreement on assessed value or tax rate. All jurisdictions that levy taxes are required to allow property owners to go to court to contest assessed values and/or tax amounts. The most common first step in the appeal process is to contact the local assessor’s office. Some jurisdictions have a simple process that only involves an application and paying the required fees, but many others are not as streamlined. In either case, collaborating with a professional to oversee the appeal process is recommended. Disputing property taxes simply means you are requesting a review and will not be penalized for taking such action.

Recent studies have shown that there are many properties that are likely over-assessed; however, very few property owners protest these assessments. Even if an appeal has been filed, property owners must pay the property tax amount when due. Disputing an assessed value or property tax is not viewed as an excuse to not pay the amount owed, rather a refund will be processed if a dispute is successful.

Property Taxes Throughout the U.S.

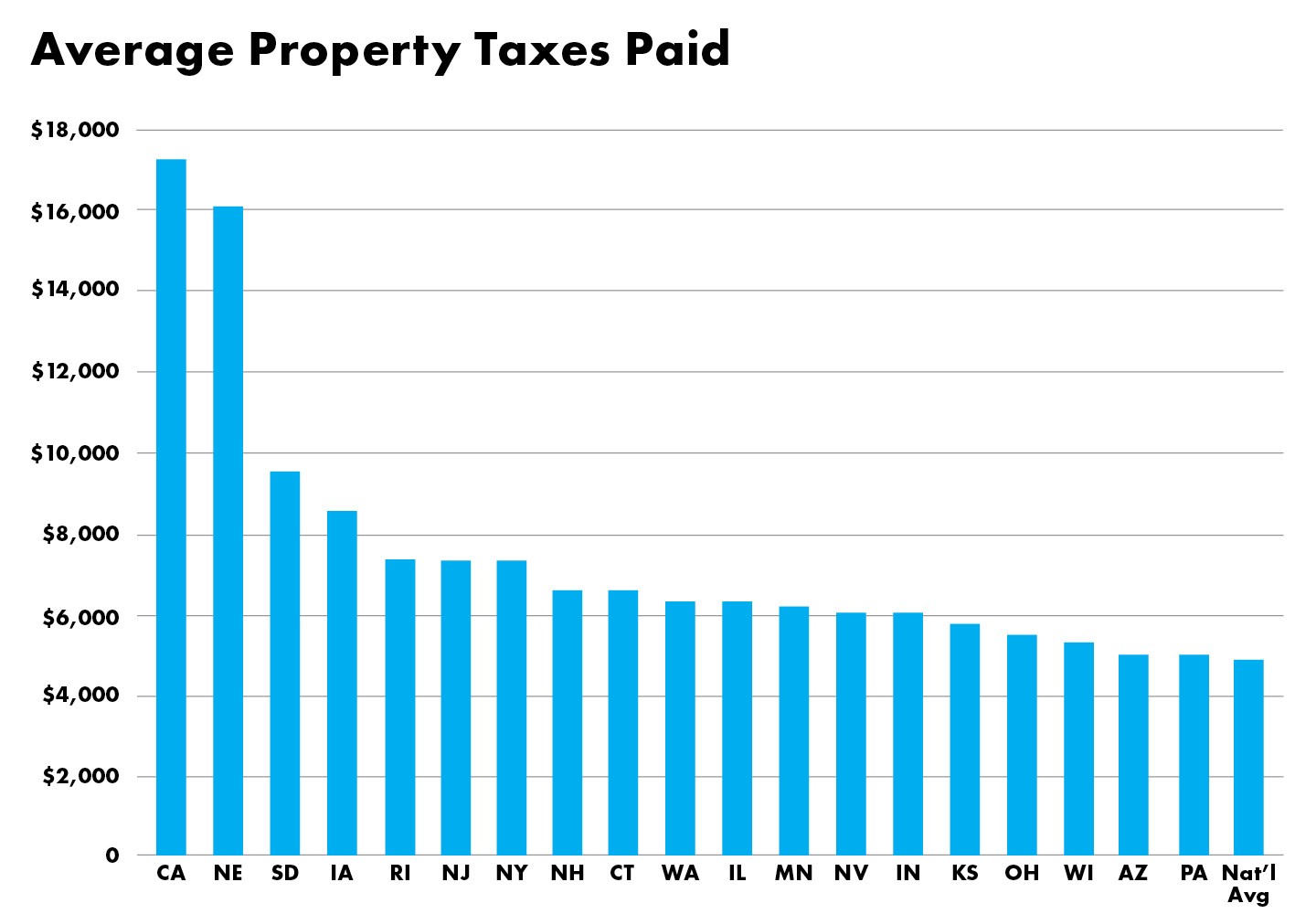

Property taxes vary greatly across the country. A study completed in 2017 revealed that California farmers pay more on average than any other state in the country, with an average property tax bill of $17,299 per farm. The USDA has found that property taxes are becoming a major portion of production expenses on farms and are continually increasing. The same study that was completed in 2017 found that California property taxes paid rose 26.5% from 2012-2017. Property taxes are owed on the value of the property whether the property is leveraged or not, so it is critical to consider the expense when determining where to buy and establishing a budget.

Source: USDA

Property Tax Impacts on Investments

Property taxes get much more attention and bring about many considerations when analyzed by land investors. When evaluating a property’s potential income and return, property taxes are classified as an annual expense. If a farm is purchased for $10,000 per tillable acre and is rented for $300 per tillable acre, then the gross return is 3% annually. If property taxes equate to $50 per tillable acre, the net return diminishes to 2.5% annually.

A real-world example is a 240-acre farm in Southern Minnesota that was in our acquisition pipeline in 2018. The farm had an annual property tax amount of $97 per tillable acre. The USDA county average cash rent that year was $217 per tillable acre. At these rates, property taxes required nearly 45% of annual income received. This farm was not a viable investment due to this ratio since the purchase price did not reflect the above-average tax burden.

High property taxes are not a deal breaker in every investment deal but do need to be considered when valuing properties. The net income of a property directly correlates with valuations along with comparable sales. Properties with higher annual property tax amounts without higher annual revenues will have lower values. For example, if two farms possess the same quality and revenue potential, the property with the higher annual property tax will almost always be worth less than the property with lower taxes all else the same.

Property taxes are a constant and consistent expense as a property owner. Property taxes provide much-needed funding to public services and are completely necessary when used in the correct manner by taxing authorities. As a potential land investor, it is important to understand the annual expenses of a land investment and how it will affect the annual revenue as well as return on investment. Property taxes are public information and can be easily obtained from the county assessor. Annual assessments that are not as straightforward or easy to obtain include drainage district assessments, irrigation assessments, and occupation taxes, and can be charged due to public use of a shared benefit such as a drainage ditch, groundwater or surface water for irrigation, or different jurisdictions that have annual tax assessments for a variety of reasons. Contact Alternative Equity Advisors by visiting AlternativeEquityAdvisors.com or emailing Hunter@AlternativeEquityAdvisors.com to better understand potential land investment opportunities as well as maximize net income and annual return on investments.