What Rising Grain Prices Mean for Landowners & Operators

Published on May 11, 2021 by Peter Isaacson, AFM, AAC

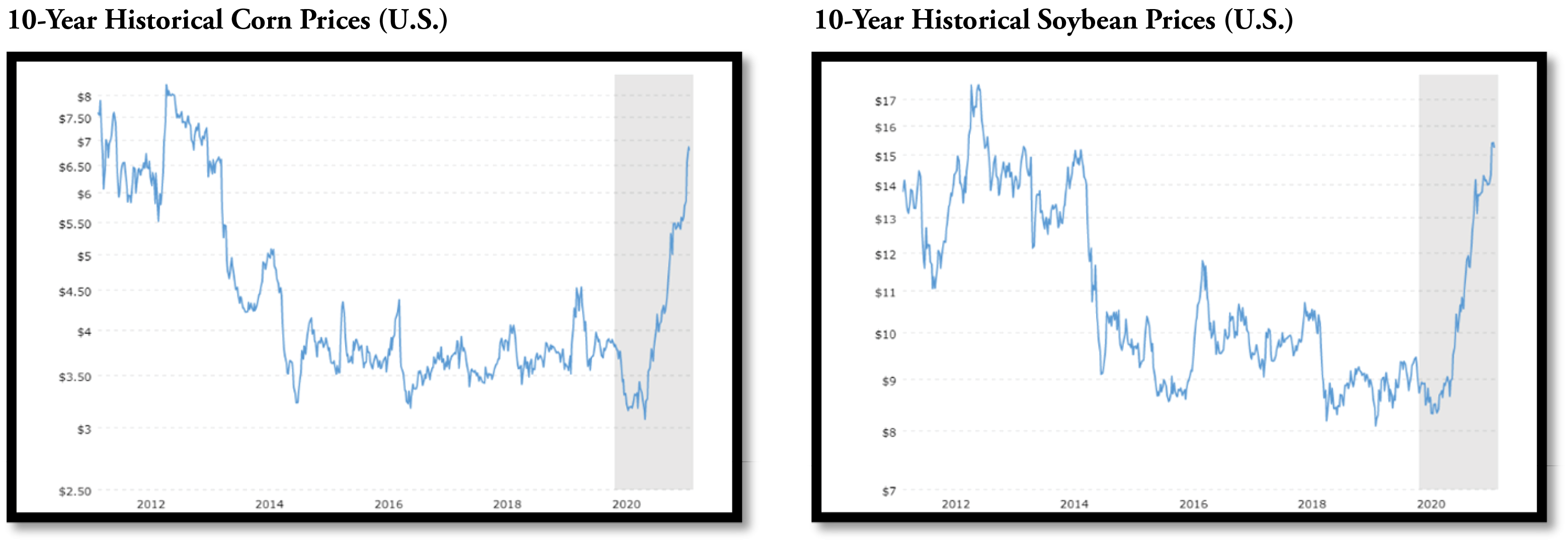

Commodity prices have been nothing short of a roller coaster ride over the last decade, with some really good years as well as some very poor years. The late 2000’s and early 2010’s boasted record high prices stemming from high demand and low supply, with corn hitting its peak at $8.43 per bushel in August of 2012, and soybeans hitting its high of $17.71 per bushel in September of 2012. These record prices were short lived, and by the fall of 2014, corn prices had fallen by 62% and soybean prices fell by 48%. The struggle for farm operators was that many inputs required to grow the crop (seed, chemical, fertilizer, land costs, etc.) remained at 2012 levels.

Since the summer of 2020, commodity prices have been on a sharp upwards trend after a regional drought throughout the Midwest, Derecho damage in the corn belt, limited rainfall in South America, and increased trade overseas. Since the low of 2020, the price of corn has increased over 138.5% and the price of soybeans over 99.3%, returning to levels not seen since 2012-2013. While prices for the 2021 crop have risen significantly, much of the current commotion in the market regards to the 2020 crop that has already been harvested and likely sold. If farmers do not have any old crop in storage or unsold, they are unable to capitalize on the current +$7/bushel prices for corn and +$15/bushel for soybeans.

What does this mean for landowners and farm operators? Probably a lot of the same things we saw in the early 2010’s.

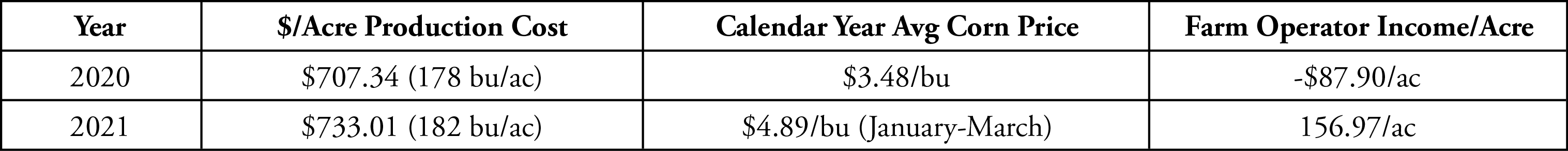

Many people will be quick to assume farm operators will be making money hand over fist with the 2021 crop, but it’s important to study production costs and their impact on profit margins this fall. Iowa State University reported the following input costs, including land in January of 2021, which have likely increased since their release. 2020 State average yield was used, and 2021 yield is the 10-yr State average yield.

2021 Iowa State Estimated Cost of Crop Production | 2020 Iowa State Estimated Cost of Crop Production

While this increased income may seem very appealing, retailers, input suppliers, and landowners are eager to capitalize on rising commodity prices and collect their share. For instance, anhydrous ammonia (a common form of nitrogen fertilizer for corn) could be contracted last December for $420/ton, was contracting for $685/ton in DTN’s April fertilizer price report, a 63% increase in just 4 months. Like fertilizer, other inputs such as seed, chemical, fuel (+20%), and land rents have either increased already or will be up significantly by the fall of 2021/spring of 2022. These large increases have the potential to keep profit margins in line with previous years.

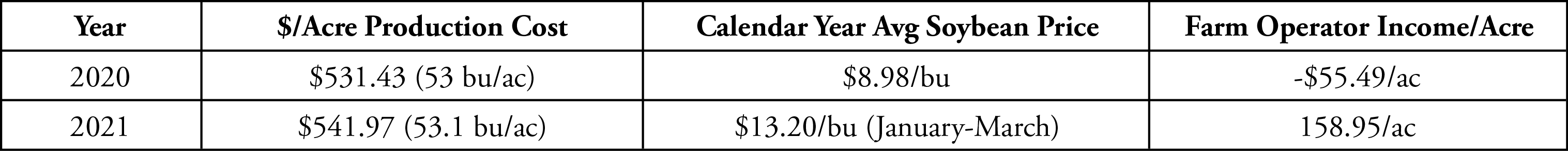

A similar story can be said for soybeans. Prices for the grain continue to climb, along with the inputs required to grow the crop. A significant production cost has not been recognized between 2020 and 2021, but production costs will likely be much higher by the time the 2022 crop is going into the ground if prices remain at current levels. Iowa State reported the following input costs, including land in January of 2021, which have likely increased since their release. 2020 State average yield was used, and 2021 yield is the 10-yr State average yield.

2021 Iowa State Estimated Cost of Crop Production | 2020 Iowa State Estimated Cost of Crop Production

2020 was a challenging year for farm operators, but many producers did not see the loses projected in the tables illustrated. The USDA stepped in to provide over $1 billion dollars worth of assistance to Iowa’s agricultural producers over the course of 2020 through the Corona Virus Food Assistance Program (CFAP). So far there have been two rounds of payments and talks of a third round in 2021 with almost every form of agricultural product covered. Without these payments, the impact of the early 2020 commodity prices could have had a more negative impact on agricultural producers nationwide.

2021 is looking to be a favorable year for farm operators thus far, but in the second week of May with over half of the nations corn and soybeans still waiting to be planted, there is still plenty of opportunity for weather events, lingering drought, trade disputes, and changing demands for raw agricultural goods. If current commodity markets can remain strong and demands can be filled, it will be a year of recovery and growth for most farm operators. For landowners, it will be important to continue watching commodity prices, anticipated yields, and the increasing cost of production when negotiating rental rates this fall. Things seem to work best when all parties involved are making money, and what is fair right now may not be sustainable long term.

Peoples Company land managers are experts in farm leases, custom agreements, and a full-service resource for landowners who don’t have time or keep up with current trends in agriculture.

If you are interested in what higher commodity prices mean to you as a landowner, or are interested in learning more about professional land management, visit www.PeoplesCompany.com or call 515.222.1347 to talk to a Peoples Company land manager.