Investing in Farmland Through Individual Retirement Accounts

Published on Oct 27, 2021 by Peoples Company

By Heather Welch Puri | Finance Manager, Land Investment

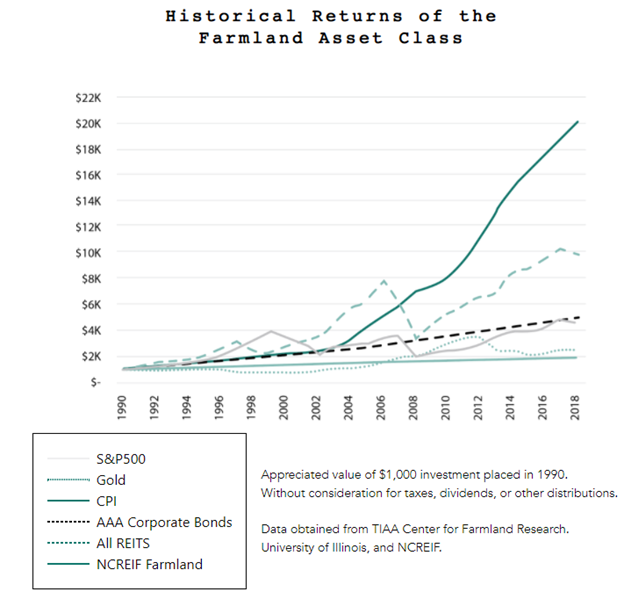

Farmland is known to provide several key benefits to investors, including valuable portfolio diversification, low volatility of returns, an effective hedge against inflation, and innumerable social and economic benefits. Further, farmland has historically outperformed other asset classes by a multiple of 2 times or more. From 1981 to 2018, farmland investments generated total returns from income and appreciation of nearly 12% per year.

Despite the lower risk profile and higher potential return of farmland compared to traditional asset classes, many investors are not aware that farmland can be purchased through their IRAs. As long as certain IRS regulations are met, investing in farmland within an IRA allows investors to gain significant tax advantages on top of the benefits from the superior investment qualities of this asset class.

Investing in Farmland Through Self-Directed IRAs

Individual retirement accounts were born from the Employee Retirement Income Security Act of 1974 (ERISA), establishing tax-advantaged accounts through which individuals could accumulate funds for retirement. While most IRA investors make traditional investments (stocks, bonds, and mutual funds) through banks and financial institutions, because those are the only investment options offered, the “self-directed” IRA has become increasingly popular. Self-directed IRAs allow investors to invest retirement savings in IRS-approved alternative asset investments such as farmland. There are no income taxes on profit distributions from investments in farmland through an IRA, and any capital gains from these investments are tax-deferred (Traditional IRA) or tax-free (Roth IRA). Accordingly, this retirement vehicle creates the opportunity for investment returns to increase exponentially.

While farmland investments made inside of a self-directed IRA provide many tax advantages, these investments must follow certain rules, or else the IRA can become fully taxable and subject to penalties. Most importantly, if an investment in farmland is made through an IRA, it must be treated as a passive investment. While investors are allowed to purchase and profit from land appreciation and any crops sold, they are prohibited from putting any “sweat equity” into the farm. In other words, investors cannot engage in any farm management, farm operations, repairs, or any other active work on the farmland. Further, transactions must be arms-length in nature and no “self-dealing” may occur, meaning that the investor, his/her spouse, and any direct lineage cannot buy, sell or lease the farmland. Last, all monies must flow to and from the self-directed IRA account and not through the investor personally. The farmland investment must benefit the IRA and not result in any personal gain.

Farmland Investment Opportunities

For investors who are interested in adding farmland assets to their portfolios, but who are willing to take a more passive investment approach, purchasing farmland through a self-directed IRA is an important option to consider. Not only does farmland offer lower risk and higher potential return than other asset classes, but investing in farmland through an IRA provides significant tax advantages as well. As long as certain IRS regulations are met, no capital gains taxes are owed if farmland is purchased through an IRA, and any profit distributions can continue to grow tax-deferred or tax-free.

According to a report released by the United Nations in 2019, the world’s population is expected to increase by 2 billion persons over the next 30 years, reaching 9.7 billion in 2050.1 It is estimated that global food production must increase by at least 70 percent during this time period to meet the expanding nutritional needs of this expanding world population. However, only 7% of the Earth’s land is suitable for cultivation, and most of this land is already in crop production. As a result, the world is facing a global food production “supply-demand imbalance.”2 The rising demand for food and limited arable land supply, coupled with evolving consumer preferences for healthier, more nutritious foods, will likely create many opportunities for farmland investors to benefit. Now is a great time for investors to discuss investing in farmland within an IRA with their investment advisors.

Peoples Company has developed a proactive Land Investment Program that can help investors identify investment grade opportunities in both row crop and permanent crop farmland. We then work with investors’ financial advisors to facilitate any farmland investments to be made within self-directed IRAs. Historically, investing in U.S. farmland has not been a viable option for many individuals due to the large capital requirements, extensive knowledge and management demands, and substantial operational risk. Peoples Company’s affiliate, mAgma (mAgmaland.com), increases access to high-quality U.S. farmland by allowing investors to easily buy and sell units with low investment amounts and competitive, diversified returns through a digital platform. Using Peoples Company’s comprehensive land management platform further provides the expertise to optimize land use while using sustainable practices with no knowledge/commitment from the investor.

1 United Nations Department of Economic and Social Affairs, The World Population Prospects 2019: Highlights.

2 Forbes, “Why You Should Invest in Farmland,” August 2, 2021.